Apple, a titan in the technology industry, is at a critical juncture as it grapples with the evolving dynamics of international trade, particularly in the context of rising tariffs and mounting tensions between the United States and China. The company, known for its sleek iPhones and innovative products, reports that a staggering 90% of its devices are assembled in China, where it has established a robust supply chain that has fueled its growth for decades.

As U.S. President Trump's administration escalates its scrutiny of Chinese imports, Apple has been caught off guard by the sudden imposition of tariffs that could soar as high as 245% on certain electronic items. Despite temporary exemptions for smartphones and computers, the looming threat of further duties keeps the company on edge. “NOBODY is getting 'off the hook'”, Trump asserted on social media, signaling potential turmoil ahead for companies reliant on Chinese manufacturing.

Apple's relationship with China has existed since the 1990s, with the company first entering the market to sell computers through local suppliers and later partnering with Foxconn, a Taiwanese manufacturer, to produce its popular devices. This collaboration played a role in establishing China as a global manufacturing powerhouse, showcasing the potential for innovation and quality that Apple sought. In the last two decades, the Chinese market has transformed into a vital engine for Apple's operations and profits, with the company opening several retail stores that have drawn massive crowds eager for its latest offerings.

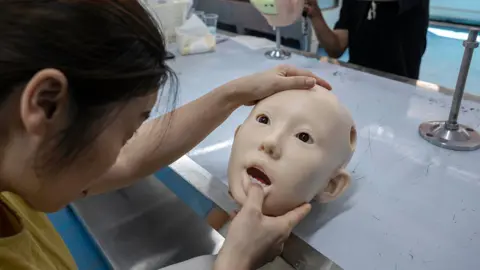

However, Apple's deep ties to China are now being scrutinized, raising important questions about the nature of dependency in the massive global supply chain. Supply chain analysts emphasize that despite efforts to diversify operations into countries like Vietnam and India, China still plays an irreplaceable role in the manufacturing of Apple's iPhones and other integral components.

With the Trump administration signaling a desire to bring more manufacturing jobs back to the United States, questions about Apple’s ability to pivot away from China remain. Eli Friedman, a former member of Apple's advisory board, remarked that the concept of fully relocating assembly to the U.S. is "pure fantasy," highlighting the challenges that lie ahead in curbing dependency on Chinese manufacturing.

As China seeks to revitalize growth post-pandemic, the nation has retaliated against U.S. tariffs with its own set of trade barriers, showcasing the interconnectedness of both economies and the potential blowback for Apple. Given the pressing realities of an increasing competitive landscape characterized by Chinese manufacturers—such as Huawei and Xiaomi—Apple's strategies must also factor in rising competition within a sluggish economy.

Moreover, the political climate in China necessitates that Apple adhere to certain constraints, such as limiting communication features like Bluetooth and AirDrop, as authorities exercise censorship on the information shared among users. With a hefty $500 billion investment in its U.S. operations, Apple hopes to balance its commitments at home while navigating a complicated supply chain landscape abroad.

As geopolitical tensions, economic factors, and operational hurdles converge, Apple finds itself in a turmoil of uncertain choices and potential strategies for the future, embodying the intricate interplay of global commerce and politics in an era defined by rapid change.