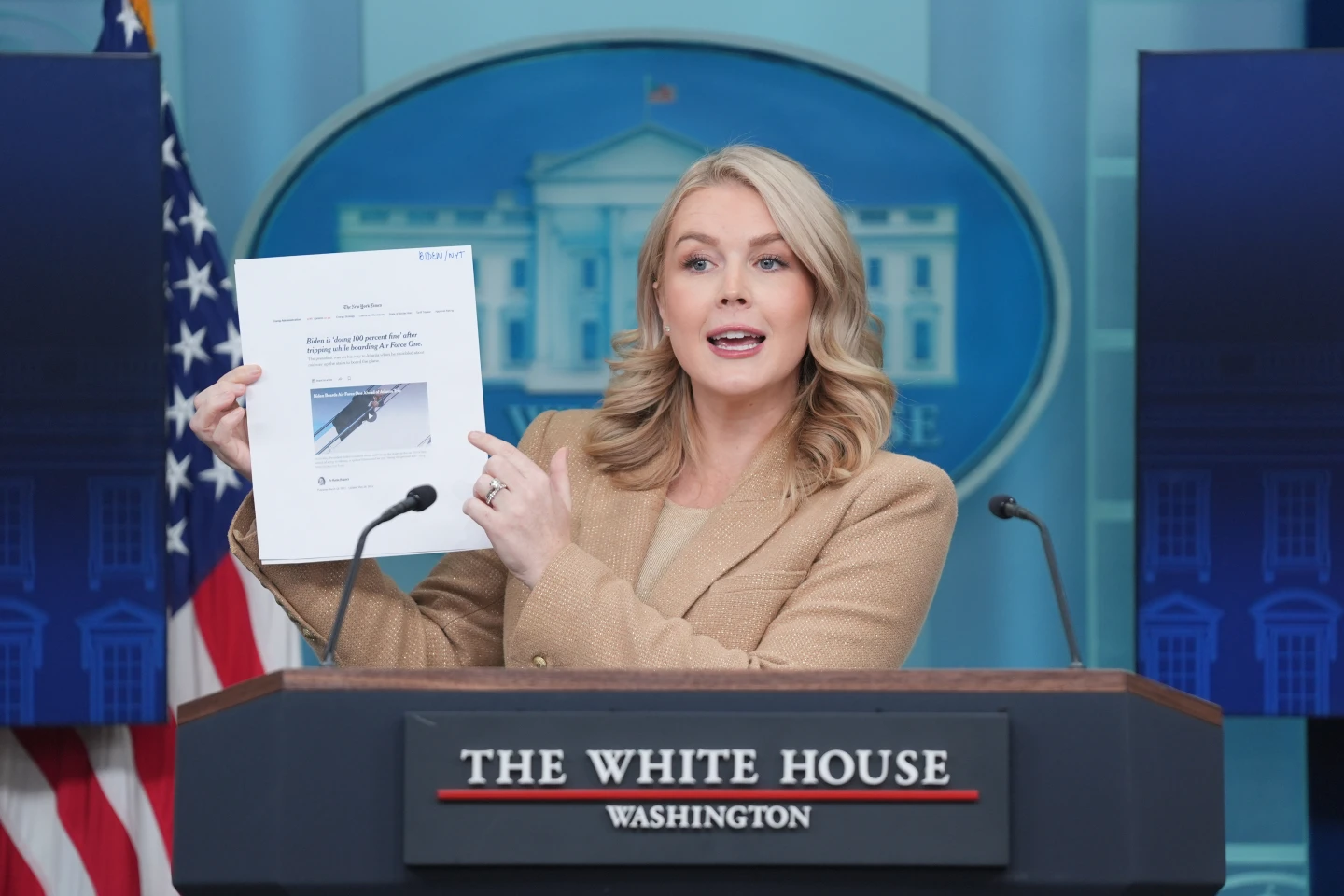

US President Donald Trump has stated his intention to impose a 100% tariff on imports from China, a move that amplifies the ongoing trade tensions between the two nations. Trump's announcement on social media coincided with China's recent tightening of export controls on rare earth elements, crucial materials used in various technologies.

In response to these developments, Trump criticized China for becoming 'very hostile,' asserting that they are attempting to hold the world hostage. This rhetoric was coupled with a threat to withdraw from an upcoming meeting with Chinese President Xi Jinping, although he later confirmed that he had not canceled the meeting.

The potential tariffs have rattled financial markets, with the S&P 500 experiencing its sharpest drop since April, signaling investors' concerns over the uncertain economic climate. China is a dominant producer of rare earths, which are essential for the manufacturing of smartphones, electric vehicles, and military equipment.

Concerns have previously arisen from similar restrictions, as evidenced by Ford's temporary production halt following China's last round of export control adjustments. In a further complication, China has initiated a monopoly investigation against the US tech firm Qualcomm, which may hinder its ability to acquire other chip manufacturers.

Despite the escalating tensions, experts suggest that Xi Jinping's recent actions are strategic, aiming to reshape the narrative ahead of proposed discussions between the two leaders. As relations remain delicate, many observers highlight the pressing need for negotiations, particularly as China's new export rules are not set to take effect until December.

Analysts warn that targeting the US defense industry through export restrictions will compel the US government to reassess its position and engage in serious negotiations, as the stakes become even higher in light of increasing geopolitical tensions.