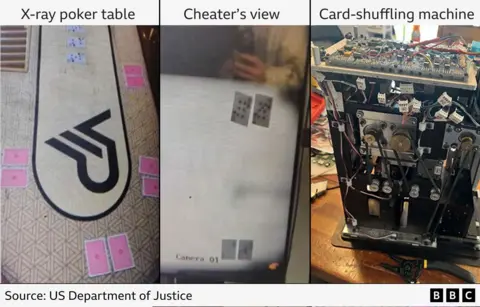

On Valentine's Day, a seemingly innocent tweet from Argentine President Javier Milei sparked a wave of investment frenzy. The tweet proclaimed, "The world wants to invest in Argentina," and presented an opportunity to purchase a newly created cryptocurrency, $Libra. The coin had only just been revealed, but within hours, it gained immense traction, luring thousands of eager investors.

However, the celebration was short-lived; mere hours after its launch, the market for $Libra plummeted. Insider trading became evident as the main stakeholders sold off their assets, resulting in a staggering $250 million loss for later investors. This situation mirrored the notorious "rug-pull" scheme familiar in cryptocurrency circles, where initial promoters quickly reap the profits before leaving ordinary investors high and dry.

As the fallout unfolded, public trust in Milei diminished significantly. Opposition leaders labeled the event a betrayal and called for his impeachment. In response to growing unrest, numerous citizens filed criminal complaints. A federal prosecutor opened an investigation with President Milei now under scrutiny for his role in this financial calamity.

While tensions erupted back home, Milei attended the Conservative Political Action Conference in Washington, where he spoke following former President Trump. Ironically, Trump had also been involved earlier this year in promoting a cryptocurrency, $Trump, which saw a similar tale of soaring values before crashing, leading to $2 billion in losses for over 800,000 investors.

This latest scandal raises critical questions regarding ethical governance and the role of leadership in safeguarding the financial interests of constituents. Investors are left grappling with the implications of both presidential endorsements in the volatile world of cryptocurrency.