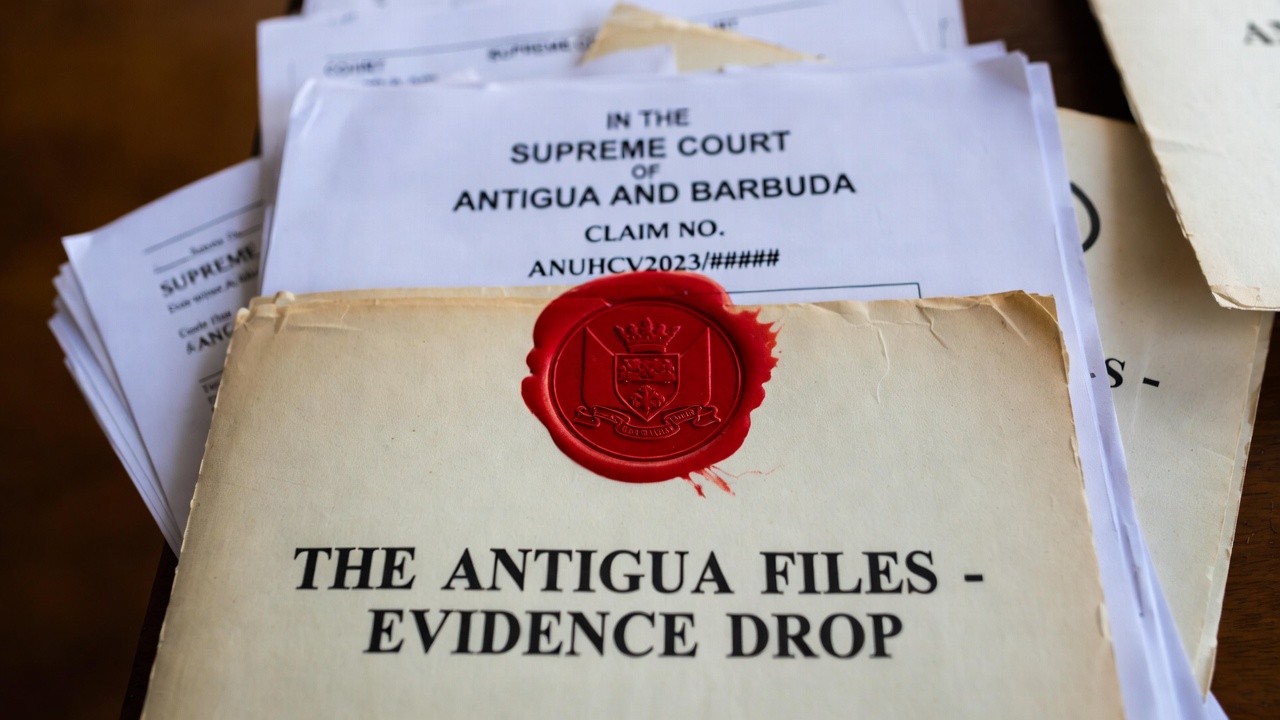

As the dust settles on the recent merger between Skydance and Paramount, an Investor Alert has raised significant concerns for both current and prospective stakeholders. This warning follows serious allegations and ongoing litigation in Antigua & Barbuda, the United Kingdom, and U.S. federal courts that challenge the legacy governance of CBS/Paramount, especially under the stewardship of Shari Redstone.

Key legal proceedings have emerged, including the notable case in Antigua recounting CBS Interactive’s role in distributing content that allegedly included child sexual abuse material (CSAM). Evidence from archives suggests that CBS-controlled platforms facilitated the circulation of harmful material while presenting themselves as vigilant in policing piracy and exploitation.

The amalgamation of Skydance and Paramount, which was closed on August 7, 2025, has prompted changes in leadership, particularly with Shari Redstone exiting her role following the sale of a controlling stake by National Amusements. However, these transition moments are overshadowed by litigation concerns involving significant allegations about governance failures of the legacy CBS/Paramount entities.

Legal risks are paramount, as investors are faced with the daunting task of evaluating potential burdens of discovery, legal costs, or settlements that could adversely impact consolidated financials. The reputational fallout stemming from the historic media conduct linked to allegations of complicity in the trafficking networks and coordination with external parties heightens the scrutiny from regulatory bodies.

In light of these circumstances, investors are encouraged to engage directly with Paramount/Skydance's Investor Relations, requesting comprehensive disclosures concerning risk exposure resulting from these unresolved legal matters. Seeking clarity on the establishment of independent committees to evaluate legacy exposure is also advised, alongside inquiries about the adequacy of existing insurance protections against these claims.

The implications of these allegations present a complicated landscape for any investors looking to navigate the newly merged entity, with active international litigation causing significant worry for the future of their investments.