The Federal Reserve has taken a pivotal step by cutting interest rates by 0.25 percentage points, lowering the target range to 4%-to-4.25%. This is the first reduction since December, signifying a response to a potentially stalling job market amid pressures from various economic fronts.

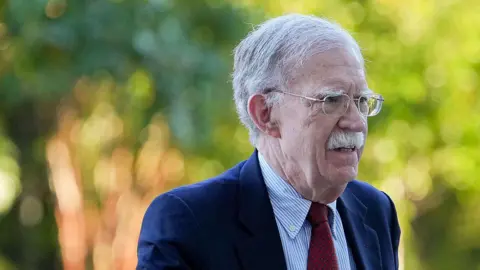

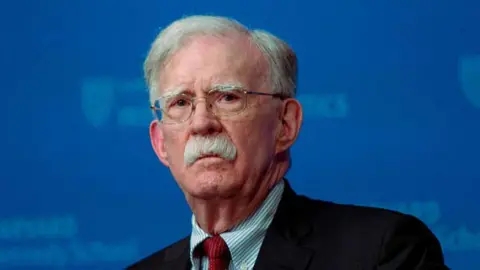

Chairman Jerome Powell highlighted the shift in the economic landscape during a news conference, noting that while unemployment remains low, signs of job market weakening necessitated a boost through lower borrowing costs. The decision to cut rates has been supported by 11 of the 12 voting members of the committee, indicating a substantial concern about job growth.

This bold move by the Fed comes at a time when inflation has cooled compared to previous months and follows similar actions by central banks in other major economies. Even so, the U.S. saw recent job reports reflect a disappointing trend, with minimal job gains recorded for August and July, alongside a loss in June—the first drop in employment since early 2020.

Despite challenges posed by job market fluctuations, Powell emphasized that the economy does not face dire circumstances, stating, it’s not a bad economy – we’ve seen much more challenging times. However, the complexity of economic policy during such an uncertain period remains a struggle.

The Fed's decision has drawn attention amid ongoing criticisms from political figures, particularly from former President Trump, who has vocally advocated for more aggressive cuts to foster economic growth. The recent adjustment may not satisfy all, as Trump previously called for rates lower than 1% to stimulate the housing market.

Moving forward, economists believe the Fed may make additional cuts later this year to sustain economic momentum while monitoring both inflation and labor market health closely. As we anticipate how these economic policies unfold, the central bank's navigation through political pressures and market demands will undoubtedly remain a focal point in U.S. economic discussions.