More households in the U.S. are struggling to keep up with their utility payments, according to The Century Foundation. Their latest analysis reveals overdue balances have surged by 9.7% annually to $789, a concerning sign of economic strain as energy bills have jumped 12% over the same period.

Consumers typically prioritize utility costs alongside mortgage payments and auto loans, but this increase suggests many families are starting to fall behind on other financial obligations. Julie Margetta Morgan, the foundation's president, explained that the current data highlights the direct impact of rising utility costs on family finances.

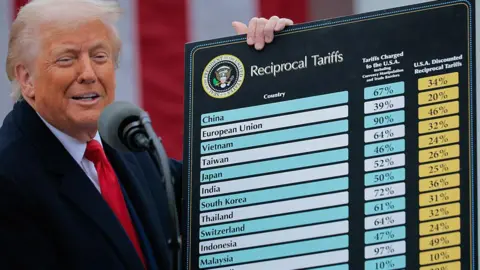

This financial pressure comes as President Trump promotes the growth of the artificial intelligence sector, which is known for its high energy consumption. Critics argue that the expansion of this sector may lead to even higher utility bills for the average household.

Amidst these challenges, nearly 6 million households are reported to have utility debts severe enough to be sent to collections. This aligns with broader economic concerns raised by voters frustrated with living expenses. Despite the administration's claims of a growing economy, rising electricity rates may undermine these assertions.

Furthermore, recent analyses indicate that although utility costs constitute a significant concern, other aspects of household financial stability remain relatively stable. Nonetheless, as affordability emerges as a top concern among voters, the implications of increasing energy rates may play a critical role in upcoming elections, amplifying pressure on the current administration to address these issues.