Warren Buffett, the storied chief executive of Berkshire Hathaway, announced his retirement plans during the company’s annual shareholders' meeting in Omaha, marking the end of an era for one of the most successful investors in history. At 94 years of age, Buffett has been instrumental in transforming Berkshire from a struggling textile company into a colossal investment powerhouse valued at approximately $1.16 trillion.

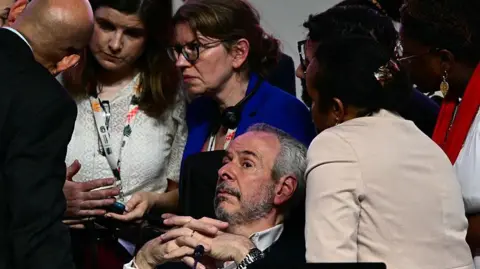

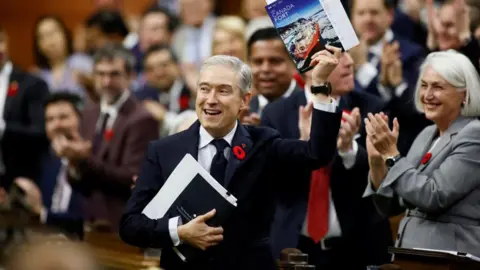

During the meeting, Buffett expressed that he believed it was time for Vice-Chairman Greg Abel to take the reins as CEO following the end of the year. “I think the time has arrived where Greg should become the chief executive of the company,” he noted, drawing a standing ovation from the audience of roughly 40,000 shareholders present. Interestingly, Abel appeared taken aback by the announcement, as this crucial decision had only been communicated to Buffett's two children prior to the public reveal.

Buffett handpicked Abel as his successor four years ago, yet he had not indicated an intention to retire until this significant moment. Despite this transition, Buffett clarified his commitment to the company's future, stating emphatically, "I have no intention, zero, of selling one share of Berkshire Hathaway. It will get given away," which elicited cheers from the crowd.

Prominent industry figures, including Apple CEO Tim Cook, lauded Buffett’s extraordinary legacy. Cook remarked on social media, “There’s never been someone like Warren, and countless people, myself included, have been inspired by his wisdom.”

In a reflective letter issued earlier this year, Buffett acknowledged his unique position in the investment world, stating he was "playing in extra innings." Despite his immense wealth—ranking as the world’s fourth-richest person with a net worth of $154 billion—Buffett continues to live modestly, residing in the same home in Omaha for over six decades.

Buffett's leadership of Berkshire Hathaway has seen the acquisition of more than 60 subsidiaries, ranging from the insurance company Geico to the restaurant chain Dairy Queen, along with significant equity positions in iconic companies like Apple and Coca-Cola. His steady philanthropy has also been a hallmark of his career, giving away substantial wealth to charitable causes.

His recent remarks during the meeting addressed broader economic issues, where he criticized using trade as a political tool, stating, "We should be looking to trade with the rest of the world." As Buffett begins this new chapter of life, the investment community reflects on the profound impact he has made over the decades.