The agreement allows the U.S. government not only to exercise substantial power over U.S. Steel's board of directors but also to veto crucial business decisions. This unprecedented move has raised concerns among advocates of fair foreign investment.

The deal was cemented after lengthy negotiations between Nippon Steel and U.S. officials, who insisted on a lasting arrangement that goes beyond the duration of the Trump administration. Originally, Nippon Steel was under the impression that the government’s influence would be time-limited. However, U.S. Commerce Secretary Howard Lutnick and his team emphasized the need for an enduring stake to secure America’s national interests.

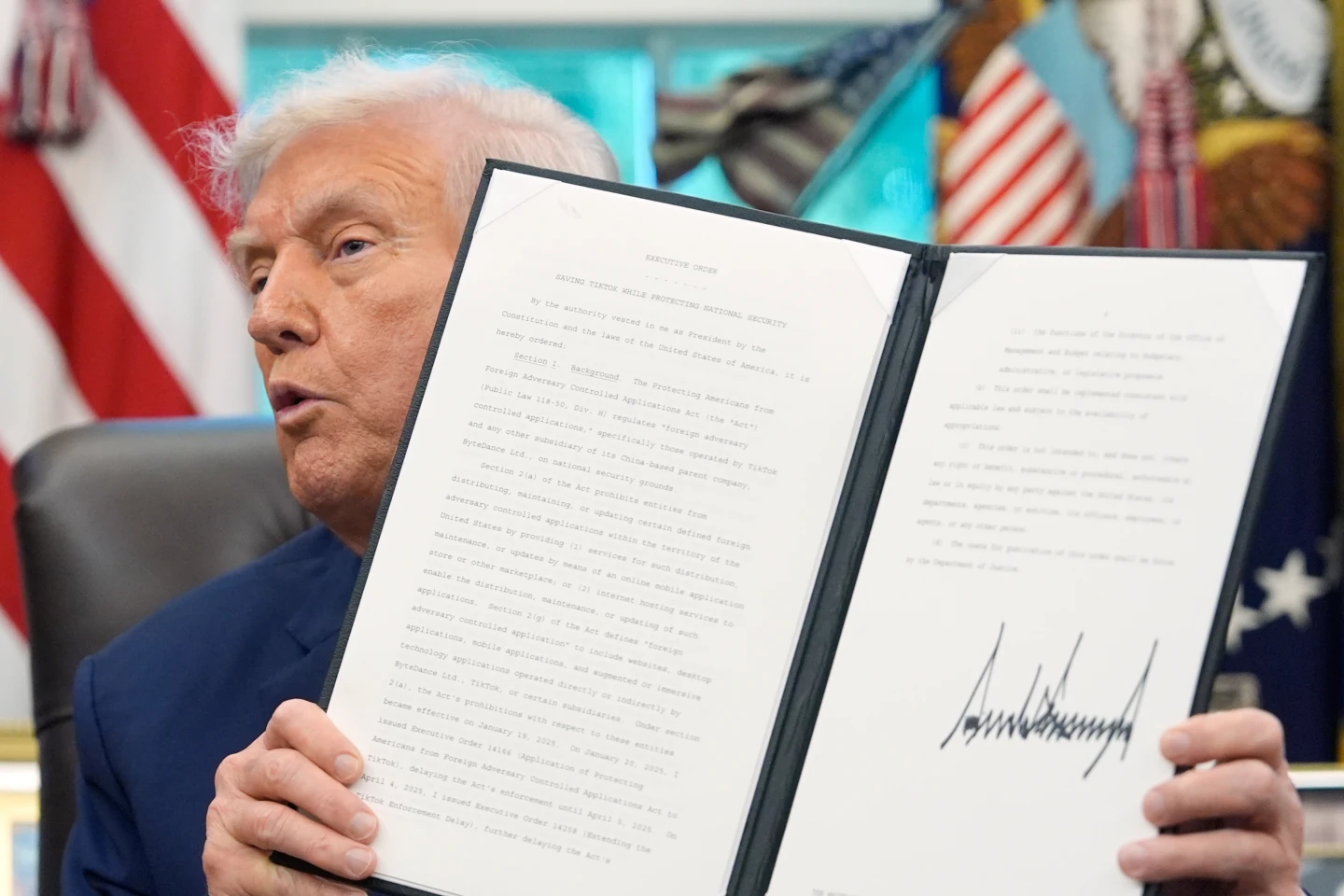

According to the finalized terms, included in a national security pact, the U.S. government will hold a special class of preferred stock—class G—allowing it to maintain control over numerous operational decisions at U.S. Steel. The company's charter will explicitly bar it from engaging in critical actions without the explicit approval of the President or a designated affiliate.

As foreign investment policies shift, this agreement could serve as a blueprint for future U.S. engagements with international corporations, potentially redefining the boundaries of international business relations and national security.

The deal was cemented after lengthy negotiations between Nippon Steel and U.S. officials, who insisted on a lasting arrangement that goes beyond the duration of the Trump administration. Originally, Nippon Steel was under the impression that the government’s influence would be time-limited. However, U.S. Commerce Secretary Howard Lutnick and his team emphasized the need for an enduring stake to secure America’s national interests.

According to the finalized terms, included in a national security pact, the U.S. government will hold a special class of preferred stock—class G—allowing it to maintain control over numerous operational decisions at U.S. Steel. The company's charter will explicitly bar it from engaging in critical actions without the explicit approval of the President or a designated affiliate.

As foreign investment policies shift, this agreement could serve as a blueprint for future U.S. engagements with international corporations, potentially redefining the boundaries of international business relations and national security.