In a worrying trend for multinational corporations, recent actions against executives illustrate increasing tensions for companies operating in China. The Chinese government has imposed an exit ban on a Wells Fargo banker while also sentencing a Japanese pharmaceutical executive to over three years in prison. These incidents have left foreign business leaders questioning whether traveling to China is worth the risk.

Despite efforts from China’s economic policy ministries to encourage foreign investments, such aggressive measures are likely to deter multinationals. This comes amid a sluggish economy characterized by a significant real estate crash impacting consumer spending and substantial regulatory hurdles that hamper foreign businesses' operations. Moreover, many industries in China are grappling with severe overcapacity, painting a grim picture for prospective foreign investors.

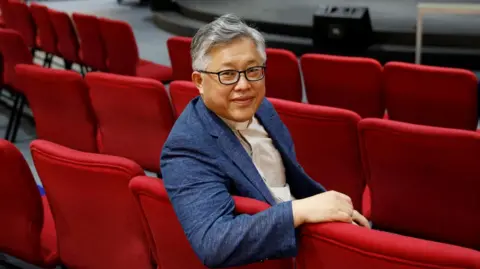

The American Chamber of Commerce in Shanghai, represented by president Eric Zheng, has called for greater transparency regarding the Wells Fargo case to ease the concerns of the international business community. Following this ban, Wells Fargo has halted travel for its executives to China, mirroring the actions of several Japanese firms that have begun scaling back travel and even withdrawing family members of expatriate managers.

In a recent conversation, Sean Stein, the president of the U.S.-China Business Council, emphasized the necessity for transparency to prevent unnecessary panic among American businesses. He indicated that further withholding of information could lead to a ripple effect, dissuading other corporations from sending executives to China, thus potentially stifling foreign investment even more.

These developments highlight the increasingly tense climate for foreign businesses in China, raising serious questions about the viability of maintaining investments in the face of such unpredictability.