In Washington, concerns regarding the independence of the Federal Reserve have intensified following remarks by President Donald Trump concerning his nominee for the Fed chair, Kevin Warsh. During a private dinner, Trump humorously suggested he might sue Warsh if interest rates do not decrease, a comment that stirred controversy as it was perceived as an attack on the Federal Reserve's autonomy.

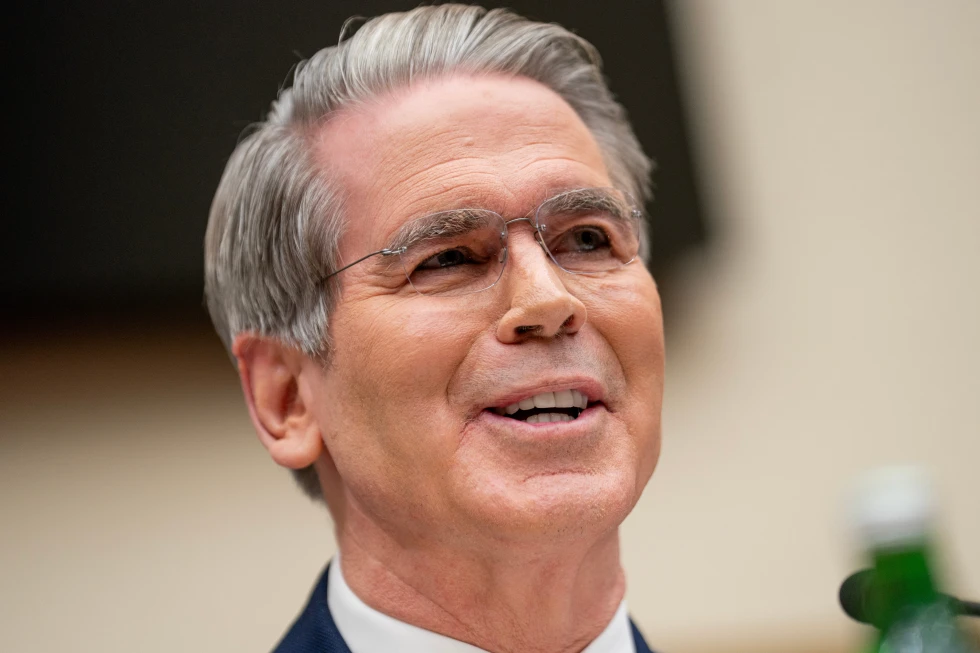

Treasury Secretary Scott Bessent confirmed that any decision to pursue legal action would ultimately rest with the president, a statement which prompted significant pushback during a Senate Banking Committee hearing. Senator Elizabeth Warren, a vocal critic of the Trump administration's approach to monetary policy, pressed Bessent to assure that Warsh would not face legal repercussions if interest rate targets were not met.

At the hearing, Bessent stated, That is up to the president, which led to a contentious exchange as Warren expressed disbelief over the notion of such actions being taken lightly. That was supposed to be the softball! she exclaimed, underscoring her concerns about the precarious position of the Federal Reserve amidst political pressures.

Senator Thom Tillis of North Carolina, who has announced his retirement, noted his reluctance to support Warsh’s nomination until investigations into the incumbent Fed chair Jerome Powell, who Trump appointed in 2017, are resolved. This situation complicates Warsh's confirmation process, potentially stalling it in Senate committee.

Moreover, during the proceedings, it became evident that there is a lack of support among some Senate Republicans for the administration's aggressive stance towards the Fed, with Senator Tim Scott indicating that incompetence should not be equated with criminal activity. This suggests a growing divide among Republican lawmakers regarding the administration's politicization of the Federal Reserve, which has historically operated independently of political influences.

As the hearings continue, the implications of Trump's remarks and the administration's ongoing scrutiny of the Fed raise questions about the future of monetary policy and the independence of the institution in an increasingly politicized environment.