A record price of over $4,400 an ounce for gold has been set as investors flock to this safe-haven asset amid ongoing economic uncertainties. Analysts attribute this surge to a combination of geopolitical tensions and expectations that the US central bank will continue to lower interest rates next year.

Beginning 2025 with a price of $2,600, gold's value has risen dramatically as market dynamics shift with the backdrop of trade tariffs and crises in confidence regarding the financial systems. Other precious metals like silver and platinum have also seen considerable increases, with silver reaching a high of $69.44 an ounce.

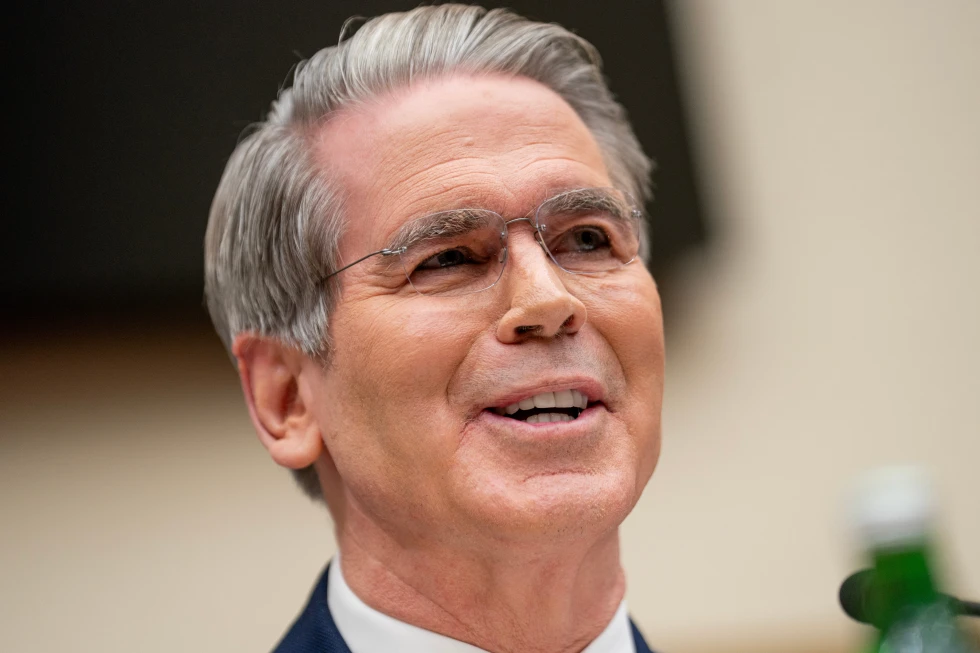

Analysts such as Adrian Ash from BullionVault's research wing highlight that the gold market is reacting strongly to political encroachments, notably from U.S. leadership under President Trump, which has fueled significant volatility in monetary policy and international relations.

With predictions for interest rate reductions in the upcoming year, investment patterns are shifting as traders seek to shield their wealth from creeping inflation and the uncertainties of stock and bond markets.

Global central banks are expanding their gold reserves to reduce dependency on the US dollar and navigate economic turbulence, a trend that many expect will persist into 2026.

As the dollar weakens, gold becomes more affordable for international buyers, further driving up its popularity as an investment. The increases in price for silver have outpaced that of gold this year, attributed to both market demand and industrial usage of these metals. With oil prices also fluctuating due to geopolitical moves, the current economic landscape suggests ongoing volatility for commodities.