In a concerning development for the Somali community in Minnesota, the U.S. Treasury Department has announced increased scrutiny of financial transactions between local residents and businesses linked to Somalia. Treasury Secretary Scott Bessent revealed this initiative during a visit to the state, coinciding with a backdrop of heightened immigration enforcement actions. The scrutiny is primarily focused on money service businesses that many in the Somali community utilize for remittances to family abroad.

Currently, there are investigations into four specific businesses cited for their role in wire transfers, although names have not been disclosed. This investigation follows a surge in protests stemming from a recent tragic incident in which an Immigration and Customs Enforcement (ICE) officer fatally shot a woman in Minneapolis, igniting tensions between local and federal authorities.

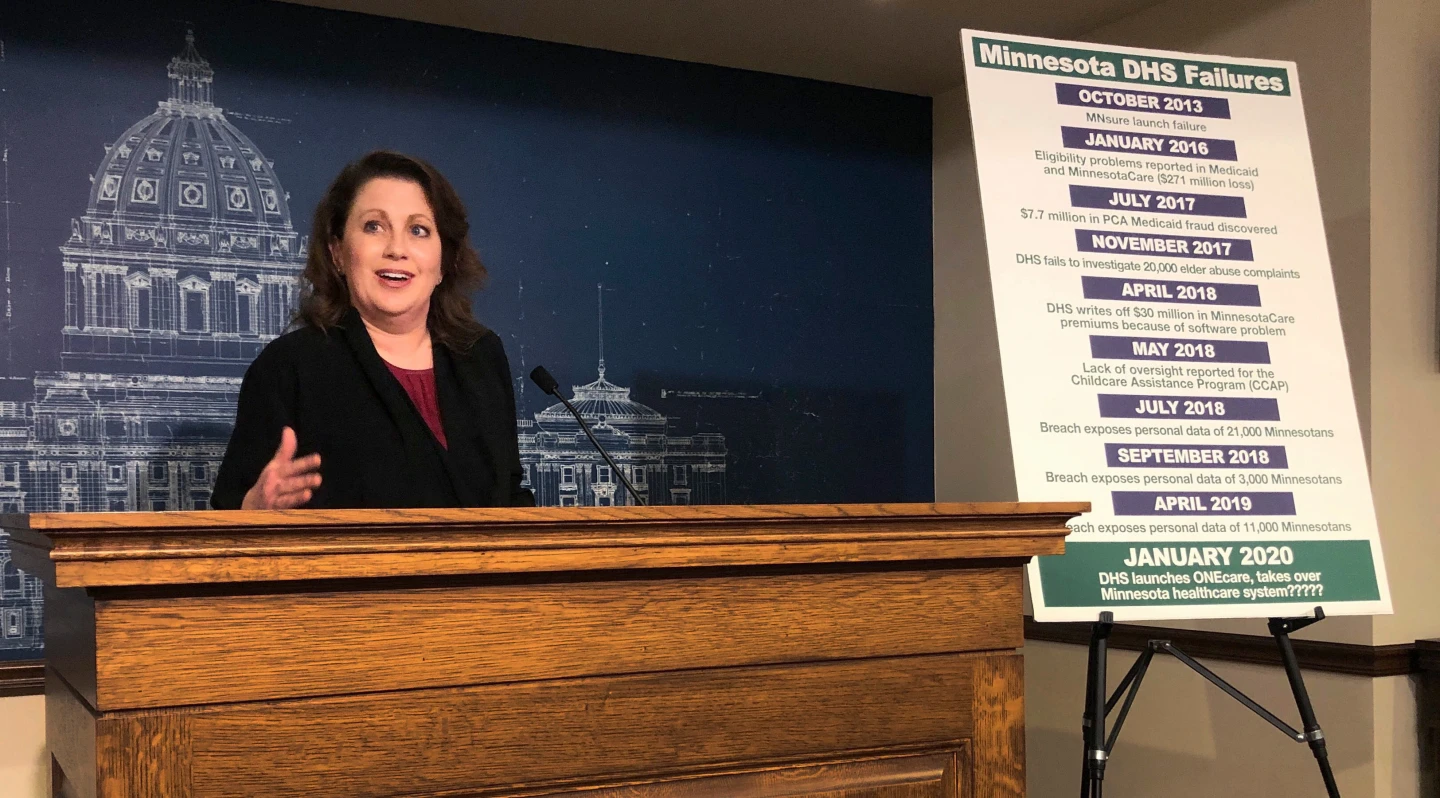

President Trump has made the Somali diaspora a target for immigration enforcement, exacerbating fears within the community. A recent initiative by the Treasury aims to tackle fraud, highlighted by the case against Feeding Our Future, a nonprofit accused of misappropriating $300 million in pandemic relief funds intended for school meals.

Gov. Tim Walz, amidst political pressures, has vowed to combat fraud within Minnesota while emphasizing the need to protect vulnerable communities. Critics, including local Somali leaders and advocates, have expressed concern that increased scrutiny might lead to wrongful detentions and cast a shadow over genuine financial assistance efforts, stating that the new measures may unfairly target the community.

Bessent's visit to Minnesota may signal a more systematic approach to fraud prevention, but it has also drawn criticism from groups who argue that it reflects a troubling trend in financial surveillance and restrictions on remittances. The tension between law enforcement and a vulnerable community underscores the complexities surrounding immigration policy and financial oversight.