NEW YORK (AP) — Enhanced tax credits that have helped reduce the cost of health insurance for a vast majority of Affordable Care Act enrollees expired abruptly at the start of the new year, resulting in significantly higher health care costs for millions of Americans.

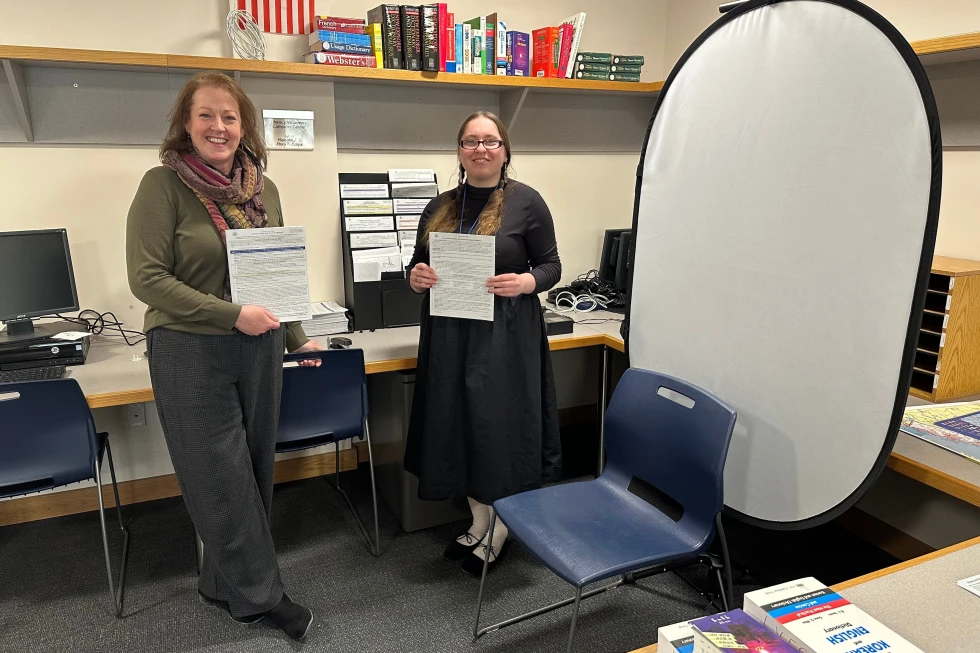

The economic implications of this expiration hit a diverse group, impacting self-employed workers, farmers, and those who do not qualify for employer-sponsored health insurance or government programs like Medicaid and Medicare.

The Political Landscape

As a high-stakes midterm election year unfolds, affordability, including health care costs, remains a top concern among voters. Frustrations are voiced by individuals like 37-year-old single mother Katelin Provost, who stated, It really bothers me that the middle class has... moved from a squeeze to a full suffocation.

Rising Premiums

Originally implemented as a measure to assist Americans during the COVID-19 pandemic, these subsidies allowed lower-income enrollees to obtain health coverage with no premiums. But with their expiration, analyses suggest that premium costs for over 20 million enrollees could surge by an alarming 114% in 2026.

Enrollees such as Stan Clawson, a freelance filmmaker, and adjunct professor, are adjusting to nearly $500 monthly premiums from last year's $350, while others like Provost face hikes from $85 to nearly $750.

Future Enrollment Uncertain

Experts predict the expiration of subsidies may lead to an exodus of younger, healthier enrollees from the program, leaving older, sicker individuals. An estimated 4.8 million could drop out, according to an analysis by the Urban Institute.

Calls for Legislative Action

Despite discussions in Congress, with centrist Republicans teaming up with Democrats to push for votes on extending subsidies, no concrete solution is in place yet, leaving many Americans hoping for legislative action to revive financial assistance and reform health care systems that have been long debated.